Real Estate Funds: A Beginner’s Guide

Real estate funds are a common option for investors who are looking to diversify their portfolio and generate returns. Unlike traditional real estate investments, real estate funds are mutual funds that invest primarily in real estate operating companies and real estate investment trusts (REITs). The global pandemic has caused significant disruptions in many industries, including real estate. However, some real estate funds have performed well during this period, particularly those focused on the residential rental market[1]. In this beginner’s guide, we’ll cover the basics of real estate funds and why investors are considering them.

What are Real Estate Funds? Real estate funds invest in a diversified portfolio of properties, including commercial properties, residential properties, industrial buildings, hotels, mortgages etc. Investors in the fund own a portion of the underlying assets and may receive returns in the form of dividends and capital gains. Real estate funds are managed by experienced professionals in the leading fund houses who have the expertise to study and analyze market strength, property quality, balance sheet strength, shareholder alignment of interest, and management team track record to make informed investment decisions and manage the properties within the fund effectively.

Why Invest in Real Estate Funds?

Real estate funds offer several potential benefits to investors, including:

1. Diversification: Real estate funds offer exposure to a diversified portfolio of properties, which can help to spread risk and minimize the impact of any one property or individual REITs’ performance on the overall portfolio.

2. Flexibility and Liquidity: Unlike traditional real estate investments, real estate funds can be bought and sold on public exchanges, providing investors with more control, flexibility, and better liquidity. For example, an investor with HK$10 million can choose to either buy a 347 square foot flat in Happy Valley[2] or invest HK$2 million each in 5 different funds separately that may be focusing on different geographies and real estate assets.

3. Attractive Returns: Real estate funds may offer attractive returns, with dividend yields higher than those of other investment options.

4. Professional Management: Real estate funds are managed by experienced professionals who have the expertise to study and analyze market strength, property quality, balance sheet strength, shareholder alignment of interest, and management team track record to make informed investment decisions and manage the properties within the fund effectively.

Types of Real Estate Funds

There are several types of real estate funds, including:

1. Equity Funds: These funds invest in real estate assets, with the goal of generating returns from rental income and capital appreciation.

2. Debt Funds: These funds invest in mortgages and other debt securities backed by real estate assets, with the goal of generating returns from interest payments.

3. Hybrid Funds: These funds invest in both real estate assets and debt securities, with the goal of generating returns from both rental income and interest payments.

4. Publicly Traded Funds: These funds are traded on public exchanges, making them easily accessible to individual investors.

Areas to Watch in Real Estate Funds:

A. Global Sector

- Real estate is becoming an increasingly important asset class for institutional investors, especially those who are looking for stable and predictable returns over the long term. Global real estate assets under management (AUM) are expected to grow from $8.7 trillion in 2020 to $11.3 trillion in 2025, according to a report by PwC, a global professional services firm[3].

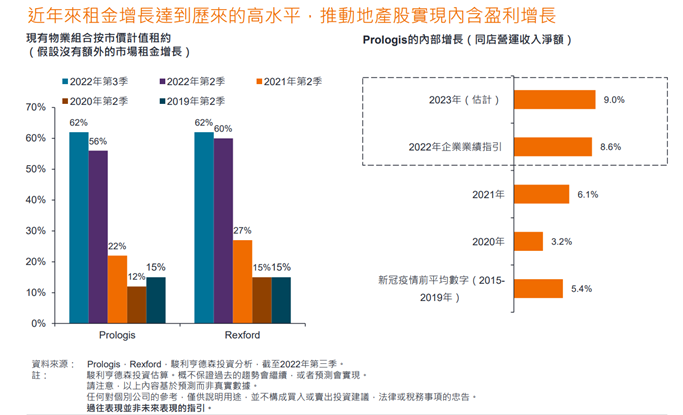

- Increase in rental income escalates real estate’s stocks: Rent growth has reached historically high levels in recent years, driving real estate stocks to achieve embedded profit growth, according to the analysis from Janus Henderson Investors[4].

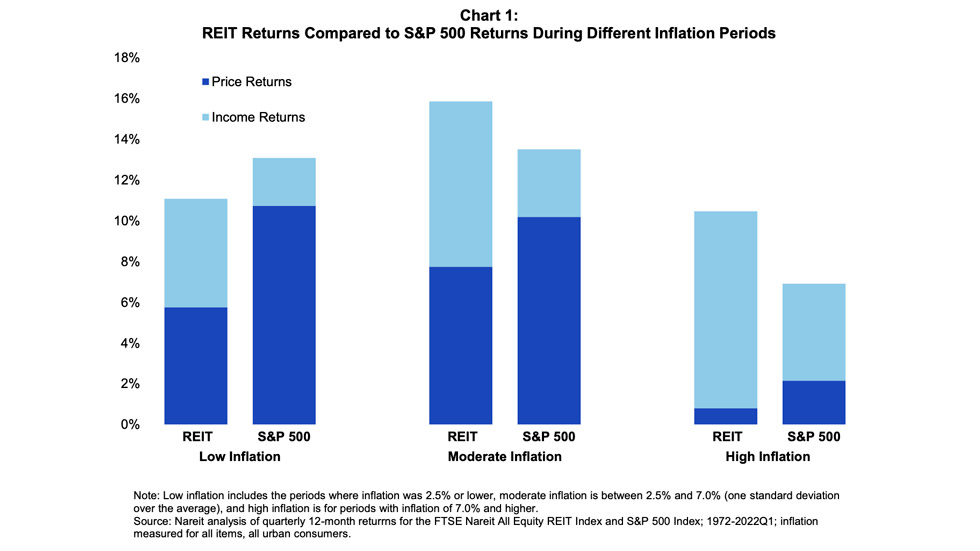

- Hedge against inflation: Properties or real estate are usually considered as natural hedge against inflation. According to the analysis of prices by Nareit in 2022, REIT have comparatively higher returns in both price and income over S&P 500, especially during high inflation period[5].

B. US Sector:

- There has been a surge in demand for real estate in certain markets, particularly in the US. This has been driven by a shortage of housing inventory, and a desire for more spacious living arrangements due to remote work. According to a report by the National Association of Realtors (NAR), existing home sales in the US increased by 5.4% in Mar 2023 from one year ago, which was the biggest surge since July of 2020[6]. Real estate funds that invest in these markets may benefit from this trend.

- The Build Back Better financial plan proposed by U.S. President Joe Biden plans to invest US$2.3 trillion in physical infrastructure improvements, which is expected to boost US economic growth in the coming years. It is believed that both technological property trusts and traditional REITs will benefit from the plan’s efforts to improve broadband networks, retrofit homes and commercial buildings, boost manufacturing, and research development.

- Increasing demand in US real estate: As countries gradually relax pandemic restrictions early this year, overseas buyers are returning to the US real estate market, especially those from China. In Q1, interest from foreign buyers in purchasing homes in the United States has reached levels comparable to those before the pandemic[7].

Conclusion

Real estate funds can be an alternative investment option for investors looking to diversify their portfolio and generate attractive returns. As investment involves risk, and with a variety of fund types and options to choose from, it’s crucial to do your research and consult with a financial advisor to determine the best fit for your investment goals and risk tolerance. Talk to your financial advisor today and see how you can leverage the potential opportunities to meet your financial goals.

[1] Data from Pension & Investment; [2] Data from Hong Kong Homes; [3] Data from PwC; [4] Data from Janus Henderson Investors Global Real Estates Funds 2023; [5] Data from Nareit; [6] Data from Trending Economics; [7] Data from SingTao Headline

#Disclaimer and Notes

Investment involves risk and past performance is not indicative of future performance. The content of this article is for reference only, and OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment if needed. Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

You May Be Interested In

OnePlatform Asset Management | 01 Oct 2024

Monetary Policy Shift in China – Analyzing Market Reactions to RRR Reduction

OnePlatform Asset Management | 09 Sep 2024

Investing Made Simple: Why You Should Choose Bond Funds Over Individual Bonds

OnePlatform Asset Management | 03 Jan 2024

Embracing Market Uncertainty: The Appeal of Multi-Asset Investments